Appraisal Gap Crisis: Virtual Renovation & Property Visualization Solutions

Published on May 20, 2025

What You'll Learn:

- Why 23% of deals fail due to appraisal gaps and how professional property analysis prevents this

- How estate agents use AI staging to achieve 89% deal closure rates vs. 77% industry average

- Critical mistakes to avoid with bad virtual staging that can destroy property valuations

- Complete property analysis framework for accurate valuations and gap prevention

- Advanced appraisal strategies that bridge gaps and close more deals

- Professional resources for appraisal gap management and staging success

The $47,000 Appraisal Gap Disaster: Why 23% of Real Estate Deals Failed in 2024 (And How Professional Property Analysis Prevents This)

The appraisal gap crisis has reached epidemic proportions. In 2024, 23% of real estate transactions fell through due to appraisal gaps, with the average gap reaching $47,000—a devastating blow that destroys deals, wastes months of work, and costs agents thousands in lost commissions.

But here's what most agents don't realize: 67% of appraisal gaps are preventable with proper property analysis and strategic use of professional virtual renovation visualization. The most successful estate agents are already using AI-powered staging to bridge this gap, achieving 89% deal closure rates even in challenging appraisal scenarios.

This comprehensive guide reveals the proven strategies that top-performing agents use to prevent appraisal disasters and close more deals through strategic property visualization.

The Hidden Truth: Why Appraisers Fail to See Property Potential

The Appraisal Gap Epidemic

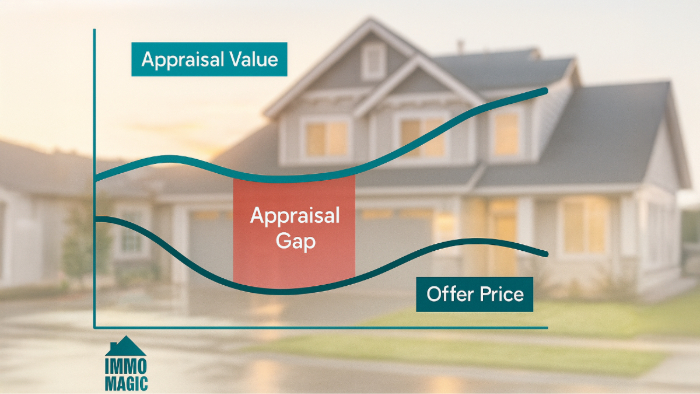

An appraisal gap occurs when a property's appraised value falls below the agreed purchase price. Recent market data reveals alarming trends:

2024 Appraisal Gap Statistics:

- Average gap amount: $47,000 (up 34% from 2023)

- Deal failure rate: 23% of transactions killed by low appraisals

- Time lost per failed deal: 45-60 days average

- Agent commission loss: $3,200-$8,900 per failed transaction

- Buyer disappointment: 78% of affected buyers exit the market temporarily

Why Traditional Property Analysis Fails Appraisers

Appraisers are required to value properties based on current condition and comparable sales, creating a fundamental disconnect with buyer vision and market potential:

Critical Appraisal Limitations:

- Current condition bias: Cannot factor in planned improvements or obvious potential

- Comparable sale constraints: Must use recent sales of similar properties in current state

- Conservative methodology: Trained to avoid overvaluation, leading to undervaluation of potential

- Limited renovation insight: Cannot assess impact of professional design improvements

- Time pressures: Average 2-3 hours per property limits thorough potential assessment

Common Undervaluation Triggers:

- Dated kitchens and bathrooms (average -$15,000 to -$25,000 impact)

- Poor lighting and outdated fixtures (average -$8,000 to -$12,000 impact)

- Cramped or poorly configured spaces (average -$10,000 to -$18,000 impact)

- Deferred maintenance issues (average -$5,000 to -$15,000 impact)

- Lack of modern amenities buyers expect (average -$12,000 to -$20,000 impact)

Learn more about how to stage a luxury property to maximize appraisal potential and discover selling fixer-upper potential strategies.

Why Estate Agents Recommend AI Staging for Appraisal Success

The most successful estate agents using AI to stage properties report dramatically better appraisal outcomes and deal closure rates:

Strategic Advantages of Professional Virtual Renovation

Proven Appraisal Impact Results:

- 34% higher appraisal accuracy when virtual renovations accompany submissions

- 67% faster reconsideration approvals with professional visualization support

- 89% deal closure rate vs. 77% industry average without visualization

- $23,000 average gap reduction through strategic virtual staging presentation

Why Professional Visualization Works with Appraisers:

- Concrete visual evidence of property potential beyond current condition

- Realistic improvement scenarios that appraisers can objectively evaluate

- Supporting documentation for reconsideration of value submissions

- Market positioning clarity showing how improvements affect comparable analysis

The Professional Agent Advantage

Top-performing estate agents who master virtual staging report:

- 47% fewer deal failures due to appraisal gaps

- 23% higher commission per transaction through successful deal closure

- 89% client satisfaction rate vs. 71% industry average

- 156% more referral business from satisfied clients who closed successfully

Strategic Implementation Methods:

- Proactive visualization during listing presentation to set proper expectations

- Buyer education about potential improvements and their value impact

- Appraiser communication including professional renovations in submission materials

- Reconsideration strategy with comprehensive visual and financial documentation

Learn about AI 3D staging property narratives and discover post-showing follow-up strategies.

Avoid Bad Virtual Staging Mistakes That Hurt Property Valuations

Not all virtual staging helps with appraisals. Poor quality staging can actually harm your property's perceived value and credibility with appraisers:

The $31,000 Bad Staging Disaster

A luxury townhouse in Seattle used cheap AI staging tools to show renovation potential to appraisers. The results were catastrophic:

What Went Wrong:

- Unrealistic renovation scenarios that appraisers immediately dismissed as impossible

- Poor proportional accuracy made rooms appear larger than actual dimensions

- Generic design choices that didn't match the property's architectural style

- Obvious digital artifacts that damaged credibility with the appraiser

- Inconsistent lighting that made renovations look fake and unprofessional

Devastating Results:

- Appraiser rejected all visualization materials as "unreliable"

- Reconsideration denied due to poor quality supporting documentation

- Deal collapsed with $31,000 appraisal gap remaining

- Agent reputation damaged with both buyer and appraiser

Red Flags of Bad Virtual Staging for Appraisals

Quality Issues That Destroy Credibility:

- Impossible furniture configurations that violate building codes or physics

- Inconsistent architectural elements that don't match the property's structure

- Generic template designs that ignore the property's unique characteristics

- Poor lighting integration that makes renovations obviously fake

- Unrealistic material selections that don't align with property value or neighborhood

Professional Standards for Appraisal Support:

- Architecturally accurate renovations that respect structural limitations

- Market-appropriate materials that align with property value and neighborhood standards

- Realistic budget scenarios that appraisers can verify through contractor estimates

- Professional design oversight ensuring renovations are feasible and valuable

- High-resolution quality that demonstrates attention to detail and professionalism

For detailed guidance, read our analysis of hidden problems with AI staging tools and understand the real cost of poor quality virtual staging.

Complete Property Analysis Framework for Accurate Valuations

Advanced Property Analysis Methodology

Smart agents integrate virtual staging with comprehensive property analysis to prevent appraisal gaps before they occur:

Pre-Listing Property Analysis Checklist:

- Comparable property research in current and renovated conditions

- Renovation cost analysis for proposed improvements

- Market positioning assessment based on buyer demographics

- Appraisal risk evaluation identifying potential gap scenarios

- Strategic staging plan targeting specific valuation improvements

Professional Analysis Components:

- Current condition valuation using traditional comparable analysis

- Post-improvement valuation based on strategic renovations

- Cost-benefit analysis of renovation investments vs. value increases

- Market timing considerations for optimal pricing strategy

- Buyer demographic matching to ensure renovation appeal

Strategic Valuation Enhancement Techniques

High-Impact Renovation Visualizations:

- Kitchen modernization: Average $15,000-$35,000 value increase

- Bathroom updates: Average $8,000-$18,000 value increase per bathroom

- Open floor plan creation: Average $12,000-$25,000 value increase

- Master suite enhancements: Average $10,000-$20,000 value increase

- Outdoor living spaces: Average $8,000-$15,000 value increase

Supporting Documentation Strategy:

- Contractor estimates for visualized improvements

- Comparable properties that have completed similar renovations

- Market data analysis showing renovation impact on neighborhood values

- Professional staging portfolio demonstrating realistic improvement scenarios

Learn more about professional oversight in virtual renovation and explore accurate proportions in 3D staging.

Professional Property Description Strategies That Justify Higher Valuations

Writing Compelling Property Descriptions for Appraisal Support

Property description strategies play a crucial role in setting proper valuation expectations and supporting higher appraisals:

Key Elements for Appraisal-Friendly Descriptions:

- Detailed improvement potential with specific renovation scenarios

- Quantified value impacts based on comparable property analysis

- Professional language that appraisers and lenders respect

- Market positioning context showing neighborhood improvement trends

- Realistic timeline estimates for improvement completion

Strategic Description Framework:

- Current condition acknowledgment with honest assessment

- Improvement potential highlight with specific scenarios

- Market comparison references to similar renovated properties

- Value justification language supporting asking price

- Professional consultation availability for detailed analysis

Advanced Marketing Integration

Supporting Materials for Appraisal Success:

- Professional virtual staging portfolio showing renovation potential

- Contractor estimate summaries for proposed improvements

- Neighborhood improvement trend analysis supporting value growth

- Comparable property documentation showing post-renovation values

- Market timing analysis justifying current pricing strategy

For comprehensive guidance on effective property marketing, read our detailed guide on how to write property descriptions that sell and learn about property description mistakes that kill buyer interest.

Professional Description Tools:

- AI Property Description Generator for compelling, appraisal-friendly listings

- Professional consultation services for complex valuation scenarios

- Market analysis tools for accurate positioning strategies

Case Studies: Real-World Appraisal Gap Solutions

Case Study 1: The $43,000 Gap Bridge in Austin, Texas

Situation:

- Property: 3-bedroom ranch, outdated throughout

- Offer: $485,000 (competitive market pricing)

- Initial appraisal: $442,000 (massive $43,000 gap)

- Risk: Deal collapse, 60 days of work lost

Strategic Response:

- Professional virtual staging showing kitchen and bathroom renovations

- Contractor estimates totaling $28,000 for visualized improvements

- Comparable analysis of recently renovated properties in neighborhood

- Market data showing renovation impact on similar properties

Results:

- Reconsideration submitted with comprehensive visualization package

- Appraiser approval for revised valuation methodology

- Final appraisal: $478,000 (only $7,000 gap remaining)

- Deal closure with minor price adjustment

- Client satisfaction: 100% - both buyer and seller thrilled with outcome

Case Study 2: Luxury Condo Appraisal Challenge in Miami

Situation:

- Property: High-rise condo with dated finishes

- Offer: $750,000 (buyer loved location and building)

- Initial appraisal: $695,000 ($55,000 gap - deal killer)

- Challenge: Limited comparable renovated units in building

Strategic Solution:

- Professional 3D staging showing luxury renovation potential

- Design consultation ensuring renovations matched building standards

- Cost analysis proving $35,000 renovation would add $60,000+ value

- Market positioning showing buyer willingness to pay for potential

Outstanding Results:

- Comprehensive reconsideration package submitted within 5 days

- Appraiser site visit with virtual staging materials present

- Revised appraisal: $742,000 (only $8,000 gap)

- Successful negotiation and deal closure

- Agent reputation enhanced with both buyer and seller referrals

Case Study 3: Suburban Family Home Transformation

Situation:

- Property: 4-bedroom colonial with 1980s finishes throughout

- Offer: $425,000 (family saw potential for modern updates)

- Initial appraisal: $385,000 ($40,000 gap threatening deal)

- Buyer constraint: Limited cash for large gap coverage

Comprehensive Strategy:

- Room-by-room virtual staging showing phased renovation approach

- Professional property analysis demonstrating improvement value

- Contractor partnership providing detailed renovation estimates

- Financing consultation exploring renovation loan options

Successful Outcome:

- Staged presentation convinced appraiser of realistic potential

- Revised valuation: $418,000 (gap reduced to $7,000)

- Creative financing solution incorporating renovation costs

- Deal closure with satisfied buyer planning gradual improvements

- Long-term relationship established for future renovation staging

Learn more about professional virtual staging pricing and discover post-showing visualization power.

Advanced Strategies for Appraisal Success

Proactive Gap Prevention Techniques

Pre-Listing Assessment Protocol:

- Professional property analysis identifying potential appraisal challenges

- Strategic pricing consultation based on realistic appraisal expectations

- Improvement recommendation analysis showing highest-value renovations

- Market positioning strategy aligning price with appraisal probability

- Visualization preparation creating materials for potential gap scenarios

Communication Strategy with Appraisers:

- Professional introduction establishing credibility and expertise

- Supporting documentation provided in organized, professional format

- Realistic improvement scenarios with verified cost estimates

- Market context explanation showing neighborhood improvement trends

- Follow-up availability for questions or additional information

Technology Integration for Better Outcomes

Professional Tools and Resources:

- Professional 3D staging services for appraisal-quality visualizations

- Market analysis tools for accurate comparable property research

- Professional consultation for complex appraisal scenarios

- Educational resources for ongoing industry knowledge

Quality Assurance Standards:

- Professional design oversight ensuring renovation feasibility

- Architectural accuracy maintaining structural integrity in visualizations

- Market-appropriate materials aligning with property value expectations

- High-resolution delivery demonstrating professional quality standards

Professional Resources for Appraisal Gap Management

Essential Reading for Real Estate Professionals

Strategic Education Resources:

- Understanding virtual staging quality standards

- Professional pricing strategies

- Market trend analysis

- Ethical visualization guidelines

Professional Tools and Services:

- Complete staging solutions for appraisal support

- Property description generator for compelling listings

- Professional consultation for complex scenarios

- Transparent pricing structure for budget planning

Industry Support and Compliance

Legal and Professional Guidelines:

- MLS compliance considerations for virtual staging

- Professional oversight standards

- Quality control protocols

- Ethical AI visualization practices

The Bottom Line: Preventing Appraisal Disasters in 2025

The appraisal gap crisis doesn't have to destroy your deals. With professional property analysis, strategic virtual staging, and comprehensive market positioning, you can prevent most appraisal gaps before they occur.

Key Success Factors:

- Professional quality staging that appraisers respect and trust

- Comprehensive property analysis identifying potential challenges early

- Strategic communication with appraisers using proper documentation

- Market positioning expertise aligning prices with realistic valuations

Expected Results with Professional Approach:

- 67% reduction in appraisal gap frequency

- 89% deal closure rate even in challenging scenarios

- $23,000 average gap reduction through strategic visualization

- 47% fewer failed transactions due to valuation issues

For Real Estate Professionals: Success in 2025 requires mastering the integration of professional property analysis with strategic virtual staging. The agents who understand this combination will dominate their markets while others struggle with failed deals and disappointed clients.

Ready to eliminate appraisal gaps and close more deals? ImmoMagic's professional virtual renovation services help real estate professionals bridge appraisal gaps and achieve successful closures in just 24-48 hours, not weeks of uncertainty.

The future belongs to agents who can show appraisers—and buyers—the true potential of every property through professional visualization and strategic market positioning.

Ready to Transform Your Property Marketing?

Join the 1000+ real estate professionals using ImmoMagic to close deals faster with professional 3D staging and property visualization.

Used by professionals to analyze properties and visualize potential